HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN S-CORP

How to save on Taxes by electing to be taxed as an S-Corp for SMLLC

Many small business owners ask us if there is a way to save on taxes. To that we respond, it depends. See if you qualify for S-Corp election to save on taxes as explained below.

Congress allows S-Corp election and Qualified Business Income deduction (section 199A) for small business owners in an effort to help small businesses stay competitive.

An S-Corp election is made via filing the IRS Form 2553. When a Single Member Limited Liability Company (SMLLC) files IRS Form 2553, it will be taxed as an S-Corporation. They will file an 1120-S tax return at year end and get a K-1 schedule which they would use report their share of income, gain, loss, deduction on Schedule E on their individual 1040 tax return.

An S-Corp is a pass-through entity for tax purposes. Meaning, you report income, gain, loss, deduction on your personal return. It generally does not pay taxes at its S-Corp entity level, unless it has the following three items.

(1) Built-in gains

(2) Excess net passive income

(3) Investment credit recapture

If the tax is more than $500 on these three items then it must make quarterly estimated tax payments. Many single business owner and small companies do not run into these situations.

Below is an example of how you can potentially have $5,000 by electing to be taxed as an S-Corp if you are currently a SMLLC.

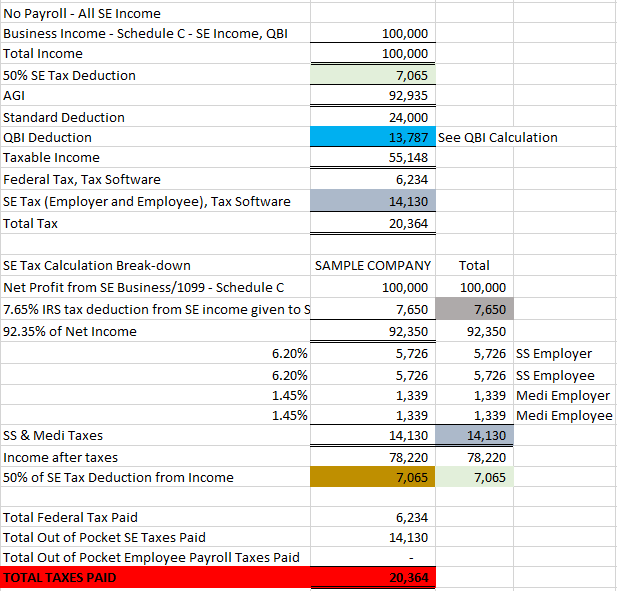

Scenario 1 – Tax Calculated as an SMLLC via 1040 Schedule C Business Income

Here are the assumptions we used in this exercise.

Net Business Income/Profit = $100,000

No Payroll

All Business Income qualifies for Qualified Business Income Deduction (section 199A)

Total Tax Calculated = 20,364

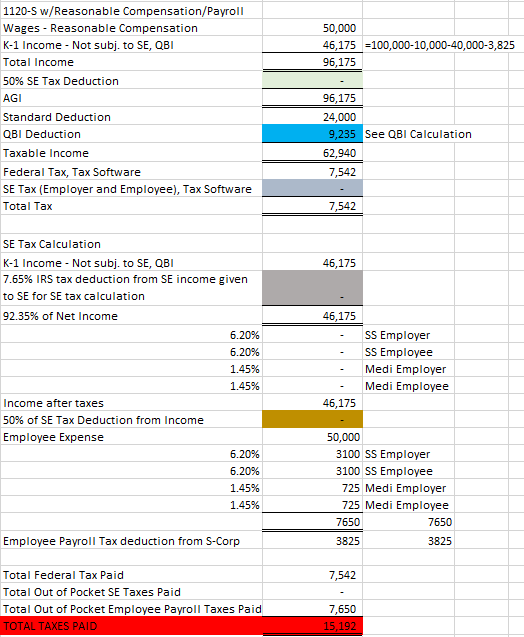

Scenario 2 – Tax Calculated as an S-Corp via 1120-S K-1

Here are the assumptions we used in this exercise.

Net Business Income/Profit = $46,175

Reasonable Compensation Included at $50,000 – Required if electing S-Corp, thus Payroll is needed.

All Business Income qualifies for Qualified Business Income Deduction (section 199A)

Total Tax Calculated = 15,192

The total tax savings $5,172.

There are two main reasons how we are able to save on taxes. They are as follows:

- By electing to be taxed as an S-Corp, the net business earning is not subject to Self-employment taxes, thus you save by not having to paying Social Security and Medicare taxes of 15.3% on business earnings.

- The Net business income qualifies as Qualified Business Income Deduction thus allowing you to reduce your taxable income.

The tax savings increases as your business income increases. However, there is a limit and the Qualified Business Income Deduction (Section 199A) starts to phase out for individuals with taxable income of $157,500 and $315,000 for MFJ.

If you are currently operating as an SMLLC and have questions with regards to making the S-Corp election email (mail@hudacpa.com) or call (832-834-5555) us to today set-up an appointment.

Plan today and enjoy the benefits.